Research Article - Journal of Finance and Marketing (2022) Volume 6, Issue 2

Novel approaches to increasing customer loyalty: Example of Cashback in Austria.

Wolfgang Neussner1*, Elena Ginina2, Natalia Kryvinska3, Maximilian Lackner1

1University of Applied Sciences Technikum Wien, Hochstadtplatz 6, 1200 Vienna, Austria

2VRVis Zentrum fur Virtual Reality und Visualisierung Forschungs-GmbH, Donau-City-Strae 11, 1220 Vienna, Austria

3University in Bratislava Odbojarov 10, 82005 Bratislava 25, Slovakia

- *Corresponding Author:

- Wolfgang Neussner

University of Applied Sciences

Technikum Wien, Hochstadtplatz 6,

1200 Vienna, Austria

E-mail: neussner@technikum-wien.at

Received: 07-Feb-2022, Manuscript No. AAJFM-22-53744; Editor assigned: 08-Feb-2022, PreQC No. AAJFM-22-53744(PQ); Reviewed: 21-Feb-2022 QC No. AAJFM-22-53744; Published: 28-Feb-2022, DOI:10.35841/aajfm-6.2.106

Citation: Neussner W, Ginina E, Kryvinska N, et al. Novel approaches to increasing customer loyalty: Example of “Cashback” in Austria. J Fin Mark. 2022;6(2):106.

Abstract

Customer loyalty has become elusive in many industries, as the internet has made comparison and switching suppliers easy. A novel approach to retain customers is “cashback”, where refunds are made to returning customers. An analysis of the customer loyalty programme "Cashback" initiated by one of the largest Austrian banks is presented. The analysis is largely based on transaction data collected within the framework of the cashback programme as well as interviews with participants of the programme. A comparison of the programme with the scientific literature is created in order to show further potentials. As of the end of 2019, 210 partners have been won for the programme. With approximately 670,000 active users, a turnover of more than EUR 250 million and refunds of approximately EUR 4.2 million have been achieved over the previous 5 years. Achievements are unique position in the market, uncomplicated access for customers (due to the basis on the Maestro card), cost savings for customers and sales promotion in almost all sectors for the partner businesses (increase in turnover per purchase, increase in frequency in the customer segment). A florist, a cash & carry wholesaler, a workshop chain for car repairs and a hairdresser supplier were studied in detail. The cash back programme is known by 90% of bank customers who regularly use the bank accounts and by 51% of bank customers who do not use the accounts as their main accounts. In total, 77% of bank customers know about the programme. 51% of all non-bank customers are aware of the programme. It can be concluded that cashback is an interesting approach to increase customer loyalty for banks and partner shops.

Keywords

Customer Loyalty, Bank, Customer Retention, Cash back, Austria

Introduction

In many areas of life, long-term ties are diminishing. This begins in the private sphere and finds expression in the rising number of people living alone in the period 2001 to 2019 in Austria, to a flexibilisation on the labour market from lifelong employment to project business or increasing resignations from the Catholic Church. The German philosopher Richard David Precht describes this "desolidarisation" as a phenomenon of increasing individualism, of rising egoism. The sense of solidarity that is no longer so strong does not even stop at banks. On 1 November 2016, Hanno Mussler wrote in the German newspaper F.A.Z. that banks are losing their customers to online banks and that young customers no longer feel tied to their bank once they enter professional life [1-4].

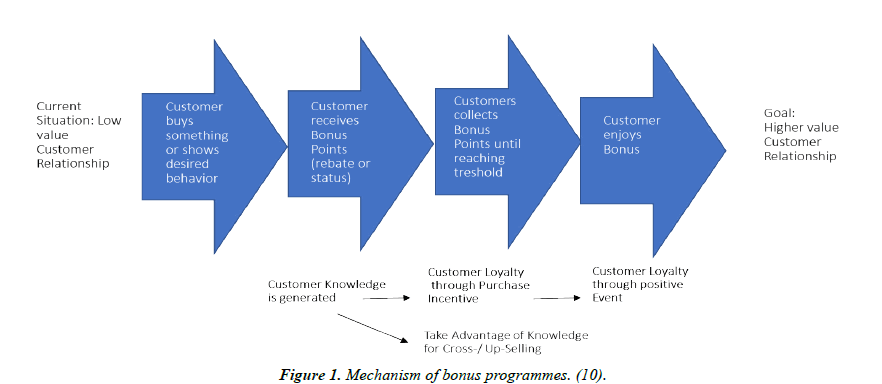

According to Ummenberger, this was the start of considerations to set up a new type of customer loyalty programme for a major Austrian bank. The following Figure 1 gives a brief overview of how customer loyalty should ideally work according to scientific literature. An existing customer relationship is to be elevated to a higher economic level. By offering a reward for a certain customer behavior, e.g. points, discounts or a more valuable status, the customer is motivated to collect. Through the purchase behaviour, a set threshold is reached and the reward is earned. If the customer can be clearly identified (by a loyalty card), cross-selling and upselling adapted to the customer should be implemented, making the customer a more commercially important customer [5], which should have a positive impact on customer lifetime value.

As shown in Table 1, the literature offers several dimensions of customer behavior bonification. Here, a distinction is made between rebate, fun & experience, status improvement or extra services.

| Immaterial Experience | Status Symbols | Higher Service Level | Cash |

|---|---|---|---|

| Fun & Experience | Status Improvement | Extra Services | Rebate |

| Limited Events | Additional Services | ||

| Visible Extra Services | |||

| Commodity | Bonus | ||

Table 1. Dimensions of bonification. Source: (10).

The project team of the bank also asked itself precisely these questions about customer loyalty. The goal was to offer the customer something that brings a unique selling proposition, that has a positive communication impact and that also links private customers with the bank's business customers. Besides offering financial advice independent of opening hours and location (this concerns a relatively small group of customers), one idea was cashback. Customers should generate a monetary benefit with every purchase/service at partner companies. The challenge for the bank was to differentiate itself from competitors and to ensure efficient customer retention. In an internal bank project, the following three possibilities for differentiation were worked out:

1. Price

2. Advice, service and quality and

3. Added value.

For a bank with a large number of branches and a corresponding quality of service, it is difficult to differentiate through price, which is why the focus was placed on added value for the customers.

The challenges of this analysis phase were:

1. Customers must be able to use the offer in an uncomplicated way

2. The effort for the partner companies must be a very small threshold, without large investments

3. There should be an ongoing positive communication content to the clients

4. This added value should be continuously visible to customers (through the permanent display of bonuses in online banking and on statements).

5. Customers should be able to save account costs through the cashback [1].

After long internal discussions, it was decided to set up a cashback programme. The aim of this paper is to analyse this programme on the basis of transaction data and interviews.

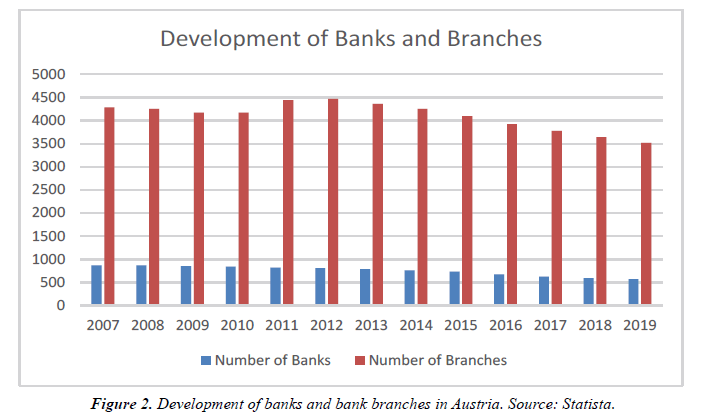

This inter-dealer cashback programme was launched of the country's largest bank at the time the programme was implemented. According to the persons involved, it was most difficult to gain an advantage in the area of price, as the bank as large organization also had corresponding fixed costs and was in competition with online banks without historically grown costs. The factors advice, service and quality appeared to be very subjective and heterogeneous and thus difficult to achieve. Creating added value for the customer was the third option and was considered promising. Comprehensive analyses showed that the implementation of a cashback programme should bring such added value for the customers. One approach is to add value to the product or service. An exchangeable product or service becomes attractive when the customer receives "more", i.e. the offer becomes "worth more" (at the same price). The ongoing personal exchange with the customer was made more difficult. For reasons of anonymity, the development of banks as well as their branches nationwide is presented here, where it can be seen that the number of branches has decreased from the peak in 2012 of 4468 to 3521 in 2019. The bank described has reduced its number of branches by about 1/3 in the comparison period [6-8] in Figure 2.

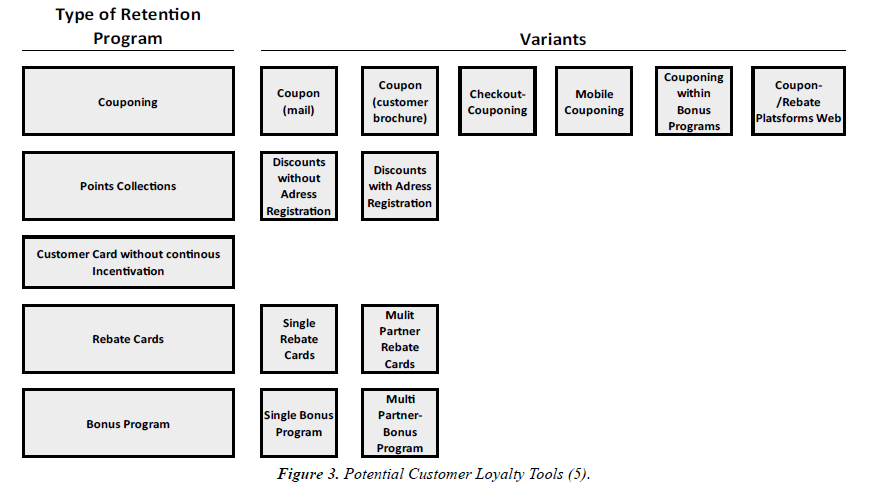

As shown in Figure 3, reward programmes can be offered as single and multi-partner programmes. In multi-partner programmes, rewards can be earned from more than one company. Multipartner programmes one should try to attract only one partner per industry to avoid competition within the programme.

Discount cards can be issued as single or multi-partner cards. With regard to the discount, a distinction must be made between an immediate discount and a refund (cash or voucher) at a later date. In order to attract customers to use their loyalty card, benefits must be provided on a current basis and not from time to time. Otherwise, there is a risk that customers will not show their membership card at every shopping event and the company will therefore lose relevant data.

If possible, point stickers should be used with address registration. For each shopping event or for a predefined purchase value, customers receive sticky points. After collecting a predefined number of points, the benefit can be redeemed [5].

Even though no customer card is required for this programme, as the existing ATM card is used, this programme is to be classified as a multi-partner bonus programme. The bonus is paid per purchase if the requirements are met (use of ATM card, achievement of minimum turnover, if required).

According to Ummenberger [1], the programme is still unique in the financial services sector in Austria years after its introduction at the beginning of 2021 for the following reasons:

1. Simplicity due to the Maestro card, which every bank customer with a current account has at their disposal at no additional cost.

2. Direct cash bonus without point’s conversion. The bank has opted for the simplest method of implementation in order to do justice to the heterogeneous customer base and to avoid losing customers due to complexity. Since there is no requirement other than a current account at this bank, the bank customer does not incur any additional costs.

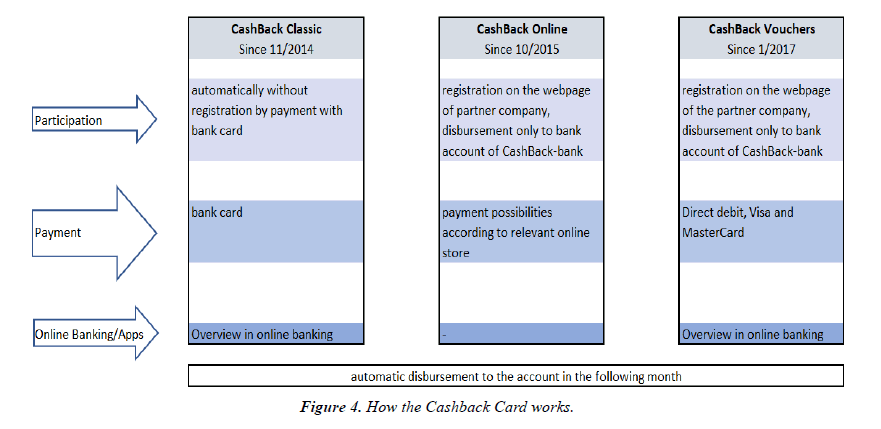

In addition to the cashback function, which works at 50 stationary partner’s offline as well as in 800 online shops, value vouchers can also be purchased in exchange for a discount. This is not a direct discount, but an indirect discount. Members of the cashback programme can purchase nondiscounted vouchers from retailers via an internet platform and receive them by email show in Figure 4. The bonus is credited to the current account as part of the next monthly statement [6].

Marketing works within the framework of the cashback programme, involving the bank branches, the online portal and online and offline media.

The three variants of the cashback programme include Cashback Classic, Cashback Online and Cashback Vouchers. Cashback Classic takes place without registration by paying with the ATM card. Participating companies and branches can be found in the mobile banking app. The area of Cashback Online is handled via a partner, in which case membership in the bank's cashback programme is recorded as part of the registration on the partner's homepage, resulting in a bonus regardless of the method of payment. The vouchers are purchased at nominal value and the refund is made to the current account.

All three options have in common that the bonus of the cashback programme can only be transferred to the current account of the bank providing the programme. The development towards multi-partner offers will continue and individual trading companies will also increasingly link up with complementary partners for customer offers. The constant demand from municipalities and regions also shows that these systems can fulfil a customer wish.

A secret of success is also the flexibility of the system for cashback partners, as it is used to implement

• No intervention in the POS system ,

• No in-house IT required

• No instruction of staff and

• No marketing costs incurred.

Value master software

According to Diethard, ValueMaster is a leading settlement and clearing platform that is used in various use cases nationally and internationally. ValueMaster describes itself as a leading "real-time" platform and processes and analyses relevant data and transactions in real time. ValueMaster is integrated as an additional service on the existing payment terminal in Austria and can process voucher cards, loyalty or bonus cards, fleet cards and clearing cards in various forms. Thanks to market coverage of around 95% of Austrian payment terminals in shops, there is also almost nationwide availability. ValueMaster provides evaluations and reports on customer behaviour or customer data (if personalised data is available), whereby these customer evaluations can be additionally enriched with external data sources in order to obtain even more detailed customer profiles. In the case of an anonymous voucher card, ValueMaster provides nonpersonalised sales data. ValueMaster is fully PCI DSS, as well as ISO 27001 and ISO 22301 certified. ValueMaster is hosted in multiple main data centres (PCI DSS certified data centres) and is multi-redundant, highly available, and multi-encrypted and therefore highly secure [9-11].

In the run-up to the introduction of the system at a merchant, it is necessary to link the ATM terminals with the cashback system in order to make the transactions traceable. A link to the POS or the merchant's enterprise resource planning system is not required, which makes implementation less costly and avoids the obstacle of integrating a partner into the company's own programme [1].

As of August 2019, the bank implementing the cashback programme had issued 1.2 million ATM cards, of which more than one million cardholders have enrolled in the cashback programme. In 2019, 210 partners achieved a turnover of EUR 25.6 million and 2,502,499 purchases were made. Ummenberger explains the seemingly low average turnover of around EUR 10 by the participating car parks or bakery shops [1].

From the point of view of the cashback programme provider, there are many advantages for retail partners. These include the fact that Cashback is not another parallel system, no separate card is required, no intervention in the retailer's internal system is necessary, no additional handling of personnel at the checkout is required, no training effort is necessary as no effort is required on the part of personnel at the checkout, no additional marketing activity in the target group processed within the framework of Cashback, as this is taken over by the bank, and a target group of over 1 million participants is addressed [1].

The possibilities of bonification are as an incentive for the cashback member either

1. a fixed percentage (but possibility of increase at certain promotional periods),

2. Bonus only from a certain purchase amount,

3. Bonus only from the second/more purchase(s) in total or per month or

4. A fixed bonus from a certain purchase amount.

From the bank's point of view, this is an interesting opportunity for customer loyalty, as the merchant partner pays part of the costs by granting discounts and rebates to the bank's customers. In addition, the bank earns fees from the merchants when payments are made with the ATM card, which further reduces the costs of the programme from the bank's point of view.

Analysis tool

As the market-leading platform for modern business intelligence solutions, Tableau software is known for capturing data from systems and turning it into meaningful insights via drag and drop [12].

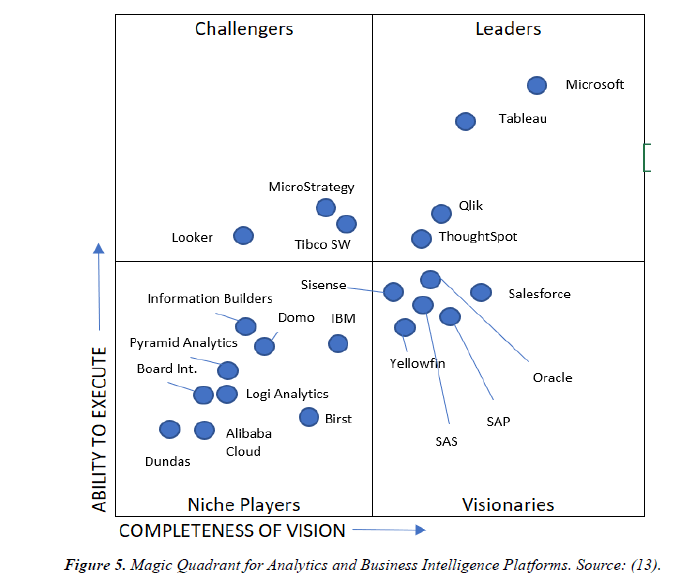

In a Gartner analysis, the magic quadrant for analytics and business intelligence platforms was presented. The result (Figure 5) shows the high attractiveness of Tableau software in terms of "Completeness of Vision" and "Ability to Execute", where it is only beaten by Microsoft [13], and see figure. 5.

The evaluations were carried out with Tableau because of the ease of use and the meaningful presentations.

Partner analysis

The following is an overview of the participating partners and an analysis of the data of individual participants. The analysis presented in this paper is based on transaction data related to the cashback programme recorded from the participants of the bank's cashback programme. The available data collections were recorded between 2016 and 2019 and correspond to different time periods, ranging from one month to three to four years. The retail partners studied use different application schemes of the cashback programme, chosen in their internal marketing units in coordination with the programme provider. Based on the data, some conclusions can be drawn about the advantages and disadvantages of the programme. However, due to the different inputs, the comparative analysis may be incomplete and some of the conclusions may not be generalisable.

In the following, findings from analyses of participants in the programme are discussed. In a period under review in the first half of 2015, participation in the programme enabled a branch-based petrol station operator to increase its turnover with ATM cardholders of the bank offering cashback by 24%. This is based on a generated frequency increase of 34.9% compared to the year before. A possible conclusion would be that by participating in the programme, more bank customers chose this petrol station chain to refuel in order to benefit from the cashback.

Over an observation period of 12 months, a branch-based furniture retailer was able to record a 28% increase in turnover with customers of the bank using the ATM card compared to the year before. Here, too, a reaction of customers to the new cashback offer could be assumed.

A perfume chain was able to increase its turnover with ATM cardholders of the bank offering cashback by 10% during the test participation period of several months, but had to accept a drop in frequency and turnover of 21% each of this target group in the month after the end of the test [1]. Here, both the positive effect of participation in the programme and the negative effect after termination can be assumed. Asking the participants why their shopping behaviour changed would help to improve the quality of the statement. Without this, the disproportionate decline in sales after the end of participation in the programme can only be assumed to be due to disappointment or loss of the advantage.

A DIY chain tested the impact of a minimum purchase in 2016 to evaluate the benefits of cashback and was able to improve the distribution of sales per voucher from 59:41 to 47:63. As a result, 63% of the receipts were achieved with the predefined minimum purchase.

An example from the system gastronomy shows that by participating in the cashback programme, an increase in average consumption of 17.8% as well as an increase in frequency of 32% could be achieved in an observation period of six months [1].

Florist

The florist (flower retailer) to be analysed is, according to its own definition, currently one of the largest seller of cut flowers in Austria and participates as a trading partner in the Bank Cashback Programme. This retailer is a flower retailer with 64 branches in 8 Austrian provinces that was branched out in the year of the analysis. This paper analyses and graphically presents transaction data collected in these branches from the beginning of 2016 to the end of 2019.

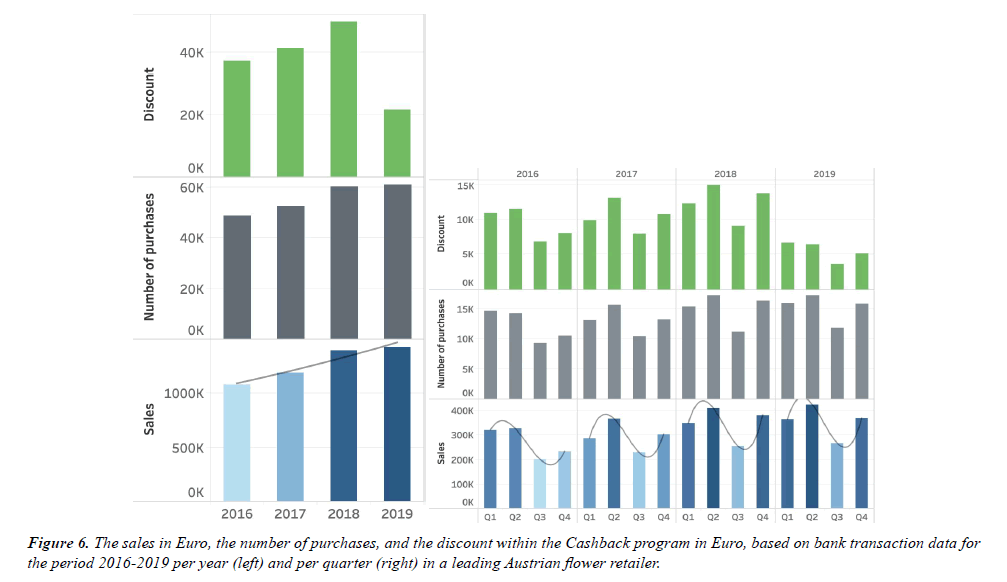

Figure 6 is a combined plot showing total turnover in euros, number of purchases and discount in euros based only on transaction data for the entire four-year period annually (left) and per quarter (right). On the left hand side, a trend of business growth in turnover and number of purchases can be read for the respective period. On the right hand side, it can be clearly seen that the business has a repeating seasonal behaviour, with the maximum of turnover and number of purchases in the second quarter and the minimum in the third quarter (Figure 7).

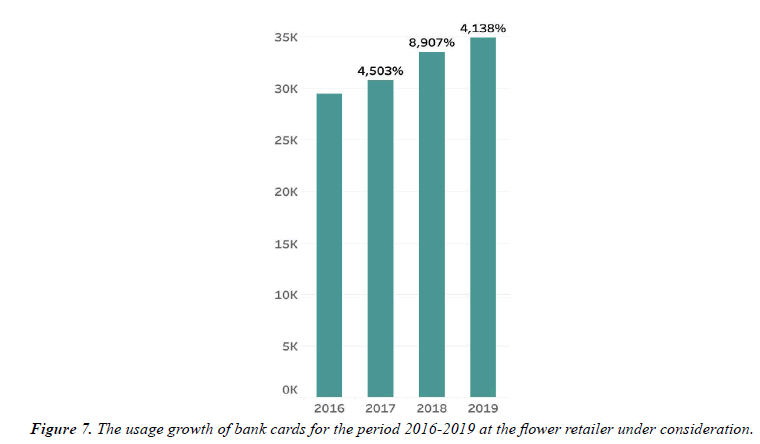

It is also noticeable that the discount plan has been changed during 2019. From the beginning of February 2019, participants were offered a 3% discount on purchases over €30, which is a significant change from the previous three years when a 5% discount was deducted for any purchase over €20. Although the change in the discount scheme has not had such a drastic impact on total sales according to the data, the increase between 2018 and 2019 is slightly lower than in the previous two years. The latter can also be seen in Figure 8, where the growth in subscriber card usage at the leading florist is shown as a percentage for the four-year period under consideration. Value you to the customer is a permanent 3% discount for purchases over EUR 30.

Figure 7 shows the continuous annual growth in the number of transactions. A habituation effect to pay with the ATM card or a concentration of the customers' turnover at this merchant could be the cause.

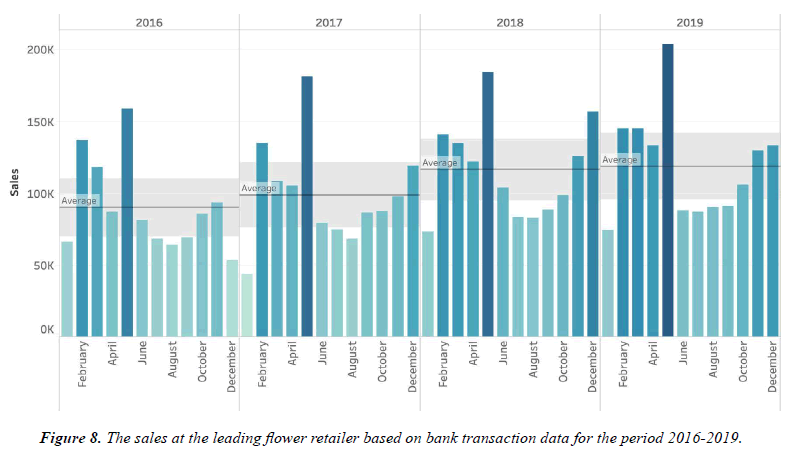

Figure 8 shows the turnover of the leading florist based on transactions per month. There is a pronounced peak in the month of May, which could be due to the special demand for the products, which could be due to seasonal products as well as occasions (Mother's Day). A smaller peak is also visible in February - possibly due to Valentine's Day. Business growth is shown by the higher position of the average sales line in the respective following year. In 2019, lower growth is again visible compared to previous years.

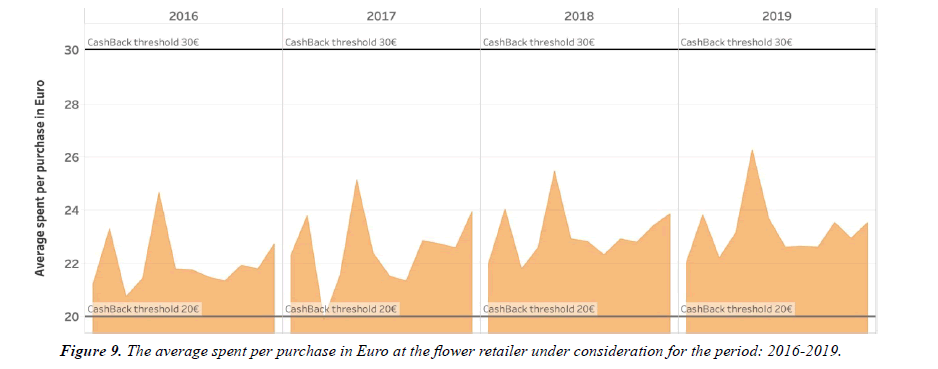

Figure 9 shows the average spent per purchase in euros at the florist under consideration for the period: 2016-2019, based on bank transaction data. For reference, both thresholds that allow the deduction of cashback are shown, 20 euros up to (and including) January 2019 and 30 euros from February 2019 onwards. The first threshold is chosen close to the average spending in the company, thus allowing the cashback deduction for most purchases. The second threshold is significantly higher than the average and only allows the cashback deduction for larger sales. It can be seen that the average spending increases throughout the period shown. However, more data is needed to draw further conclusions and answer questions such as: Do customers know and notice the cashback threshold and aim to benefit from the programme, or is there another reason for the growth.

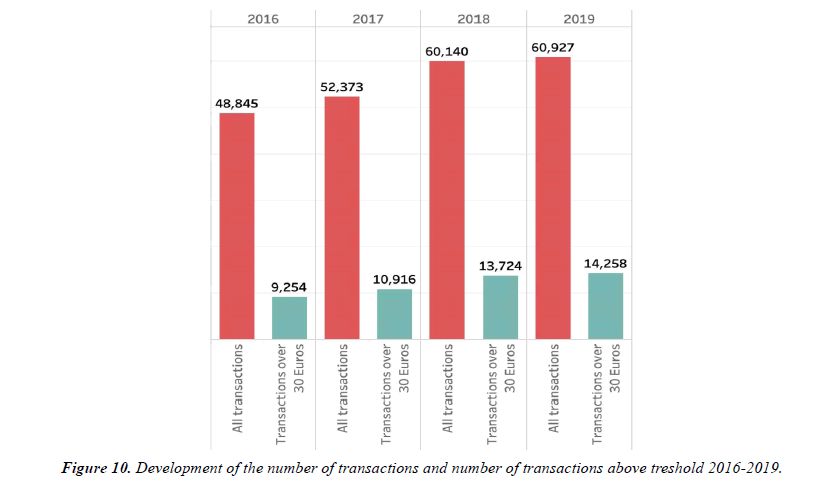

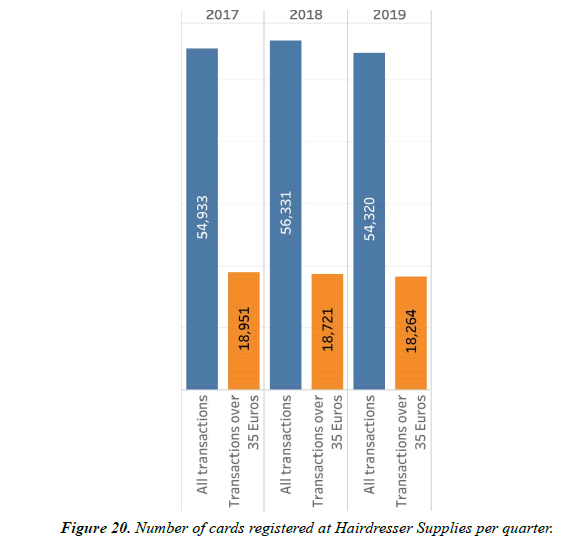

Figure 10 shows the development of the transactions and the one´s above the threshold of 30 EUR. Starting with 18.95% of the transactions over the threshold the percentage increases year per year reaching 23.40% in 2019. From the author´s point of view this could be an indicator of getting customers trained to pay more than the required threshold to receive the benefit of the cashback programme.

Cash & Carry Wholesaler

The retailer analysed here is the national branch of international cash & carry wholesale chain, which is only accessible to authorised persons.

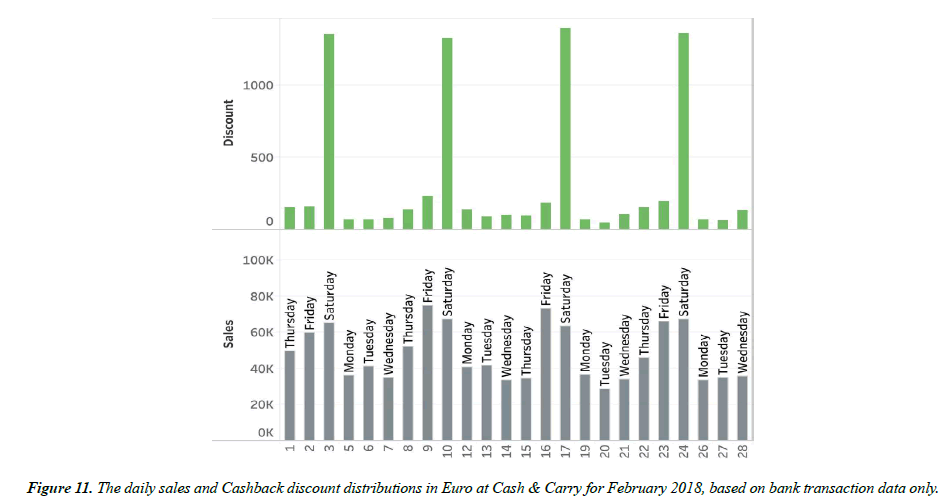

As of June 2019, this chain operates 12 stores in Austria, the first of which opened in 1972. The Cash & Carry concept is based on self-service and bulk purchasing and is aimed at businesses. The cashback programme offers a 3% discount on every purchase made during predefined time windows. During the week the discount takes place between 8pm and 10pm, on Saturdays it starts at 12pm and lasts until 6pm, the end of the working day. The effects of this discount scheme can be seen very well from Figures 10 and 11. Figure 11 shows the turnover and discount at Cash & Carry based on transaction data for February 2018. It is clear to see that turnover has a repeating pattern within the week, starting from low levels and peaking around Friday, at the beginning of the weekend.

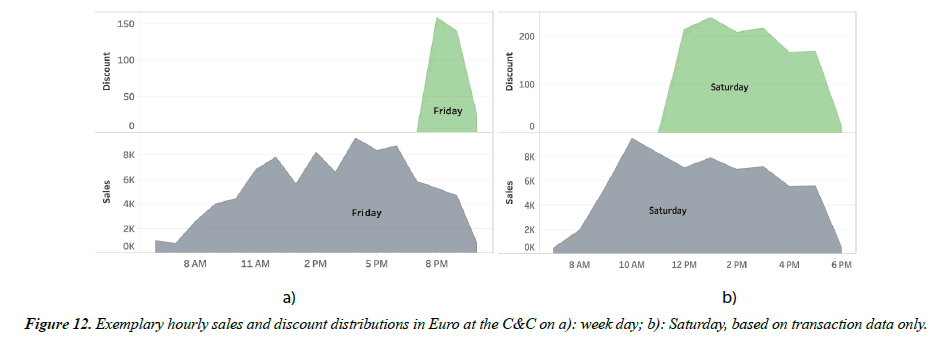

Accordingly, the amount of the discount is reflected in the course of the total turnover within the given time. Figure 12 shows an exemplary hourly distribution of turnover and discount on a weekday (Figure 12a) and on a Saturday (Figure 12a).

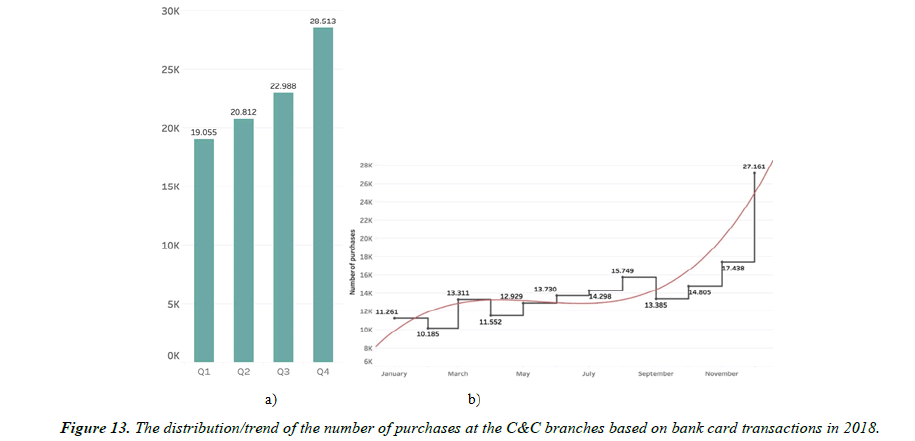

The distribution/trend of the number of purchases under the analysed programme shows 175,804 payment transactions in 2018 and is presented in Figure 12. Apart from seasonal variations, the figure shows that almost three times as many purchases were made in December than in the weakest month, February. The low spending in February could be due to the slightly lower number of days in that month, but also to the particularly strong December grocery business. Based on only one year of data, it is difficult to conclude whether the observed distribution/trend has to do with the cashback programme or another discount promotion, whether it is a typical annual distribution for this industry or just a coincidence. An observation over several years would be advisable to clarify this question.

Figure 13 shows how often cards from the cashback organising bank were used at Cash & Carry Austria in 2018, broken down by quarter, Figure 13b, and by month, Figure 13a. Note that the figures show a unique count of ATM cards, i.e. how many individual cards were used for purchases. This is why the sum of the numbers shown for Q4 in Figure 13a is not equal to the numbers shown for Q4 in Figure 13b.

In addition to bulk purchases with the club cards for business customers, smaller private purchases also take place, in line with the chain's policy. It is interesting to investigate to what extent the benefit of membership and the cashback programme discount is used for private purchases in this area. Unfortunately, the present dataset cannot reveal such dependencies, which moreover go deep into the privacy of the customers.

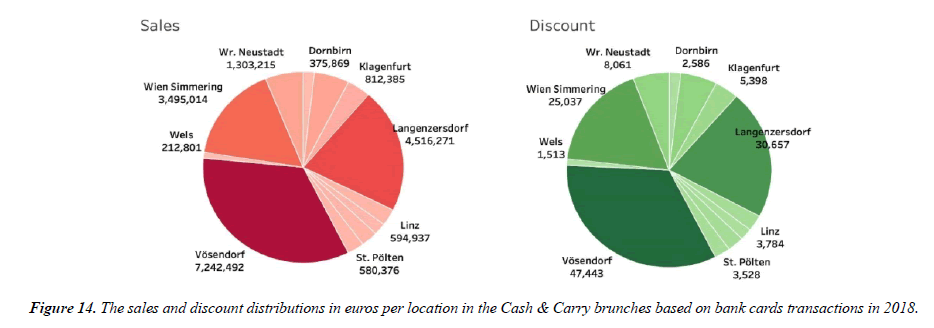

The distribution of turnover and discount per location in Cash & Carry for 2018 is shown in Figure 14. Not surprisingly, the highest amounts are spent in the (main) city of Vienna, followed by the stores in Wiener Neustadt, a satellite city of Vienna, and the second largest city in Austria, Graz.

Workshop Chain for Car Repairs

The next company to be analysed specialises in car repair and has 43 branches.

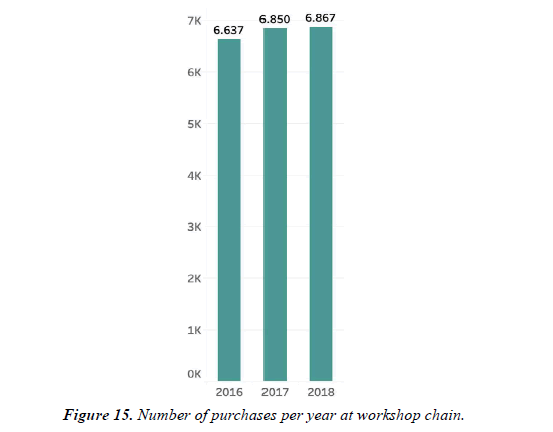

Figure 15 shows the development of the number of purchases per year. As it can be seen the number is increasing slightly over the period 2016-2018.

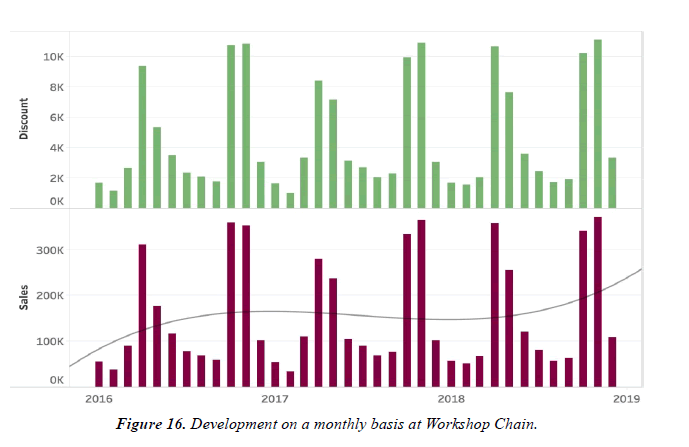

Figure 16 shows the number of times the card is used as a payment instrument at this garage chain shows the seasonality due to the mandatory winter tyre requirement in the country after a certain date, as well as the changing of tyres in spring.

Hairdresser Supplier

The next company is a trading company specialised in hairdresser supplies with more than 100 branches in Austria.

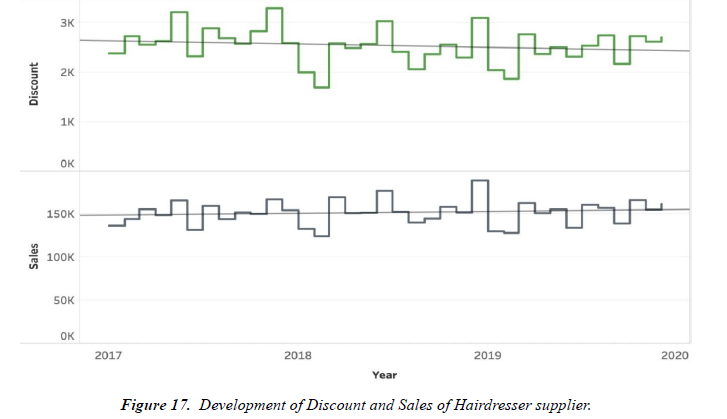

Figure 17 shows the sales and discount for the years 2017 to 2020. Figure 18 shows the average spending per purchase. The selected threshold is above average, so most customers do not benefit from the cashback programme. However, the threshold will be moved up even further at the beginning of 2018. This default does not change customer behaviour and the desired effect in changing customer behaviour is not achieved. The growth in average spend is not significant over the period shown.

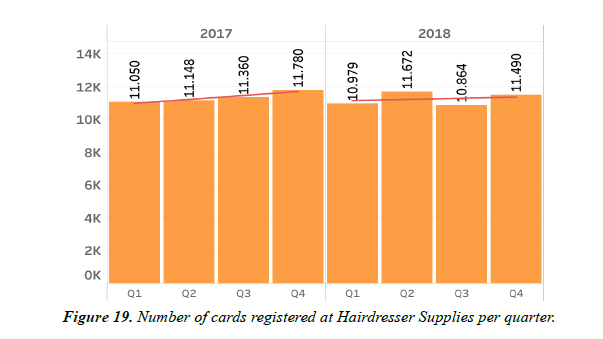

Figure 19 shows the quarterly development shows quite stable business, with a peak in the fourth quarter. Due to a lack of knowledge about the change in the number of transactions, no statement can be made about the success without further analysis.

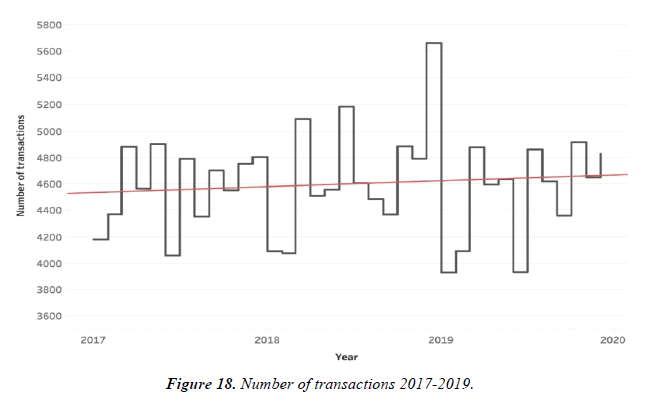

Figure 20 shows the development of the number of transactions in the years 2017 to 2019. A learning curve of the customers to buy above the threshold cannot be concluded as the percentage is fluctuating but not increasing.

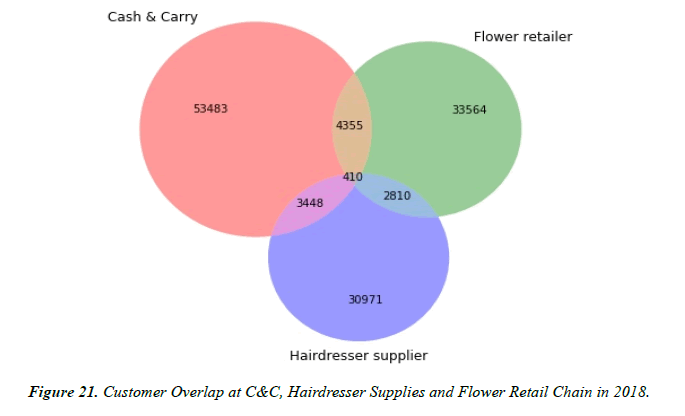

Customer Behavior

The following chart (Figure 18) shows the overlapping of customers in two or three partner shops of the Cashback program. As it can be seen from Figure 21, 3,448 of the customers buying at the C&C company also buy at the hairdresser supplier but 4,355 buy at C&C and the flower retailer as well in the year 2018. The overlap of customers who buy at the C&C company and the flower retail chain is higher with 4,335. Comparing the customer base of the flower retail chain and the hairdresser supplies 2,810 or less than 10% buy at both chains. Taking a look at the overlap of all three retailers there is still an overlap of 410 people (0.035% of all 118,018 customers). Assuming that the customer base of the hairdresser supplier shows a high percentage of females this could explain the lower overlap. From the authors' perspective it would be interesting to combine offers of two of the retailers to see the impact, as 8.6% of all customers fall into that category.

Discussion

Based on the data there are three different basic schemes of discount:

a) a fixed percentage of the price is reduced for each purchase: e.g. 3% (Car repair)

b) a fixed percentage of the price is reduced at given periods/ hours of the week/day (e.g. Cash & Carry - every day only between 8 pm and 10 pm and on Saturdays starting from 12pm to 6pm)

c) a fixed percentage of the price is reduced if the purchase exceeds a certain limit (e.g. Hairdresser supplies, Flower Retailer)

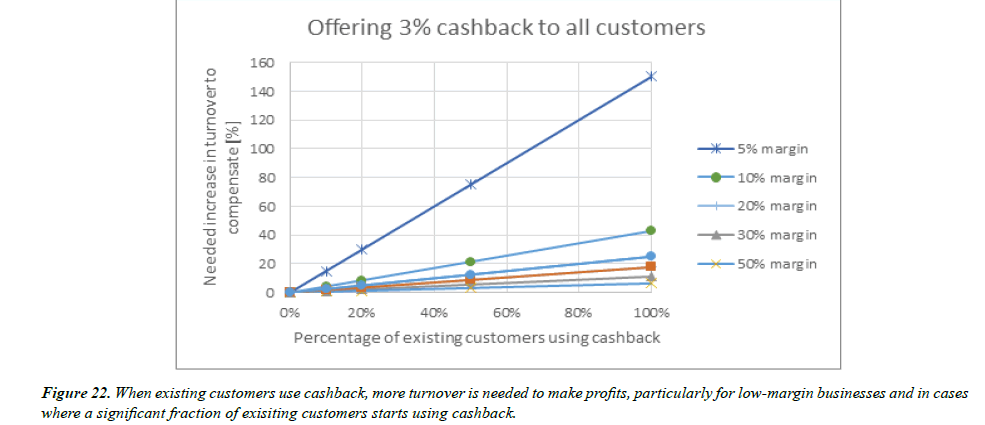

The trend analysis of the growth of total spending and number of purchases over the years in the different companies offering these schemes show that the most successful variant seems to be scheme c). The aim of the cashback programme must be to ensure that trading partners benefit and customers are tied to the bank. When existing customers start using the cashback system, additional turnover is needed to compensate for the corresponding loss in margin. This is illustrated in Figure 19 below, for an assumed constant cashback of 3%.

As Figure 22 shows, the higher the margin of the participating shop, the lower the additional turnover to compensate for losses from existing customers using cashback. A shop that has 5% margin and offers 3% cashback, for instance, would need an additional 75% in turnover in case that 50% of his existing customers use cashback, assuming zero additional costs and benefits.

So the system needs to make existing customers buy more, and/or attract additional customers.

In it was found that consumers appear more likely to spend the money returned to them at generalist retailers such as department stores, and less likely to do so in categories such as travel and subscription-based services.

As of the end of 2019, 210 partners have been won for the programme. With approximately 670,000 active users, a turnover of more than EUR 250 million and refunds of approximately EUR 4.2 million have been achieved over the previous 5 years. 5 years after the launch of the offer, the following points can be stated:

1. Unique position in the market

2. Uncomplicated access for customers (due to the basis on the Maestro card) cost savings (almost € 5 million were distributed to the customers)

3. Sales promotions in almost all sectors for the partner businesses (increase in turnover per purchase, increase in frequency in the customer segment) were achieved. [1]

4. In a survey conducted in November 2020, the following results were obtained: The cashback programme is known by 90% of bank customers who regularly use the bank accounts and by 51% of bank customers who do not use the accounts as their main accounts. In total, 77% of bank customers know about the programme. 51% of all nonbank customers are aware of the programme. [1]

This paper has assessed the situation for a mature country in Europe. Cashback also works in emerging economies such as Brazil [14,15], and is particularly suited for online sales [15,16].

Cashback has become an important system in several markets. In the United Kingdom, already in 2016, more than $64 million of cashback payments to its seven million registered users were processed by one offering company, and by this sales of close to $1 billion were facilitated for 4,300 retailers—a figure that represented 1% of all electronic commerce in the country for that year [17].

Conclusion

Within the framework of further research, it is necessary to conduct a survey among the participating traders in order to ascertain the benefits of the programme from the traders' point of view. This could lead to a further step in improving the programme. Among the obvious questions are: What is the greatest benefit for a trader? In the context of continuous bonification of sales, time-limited offers (activation of lowturnover times of day), increasing the average coupon (discount from a predefined sales level) or new logics to be tested?

References

- Statistics Austria, https://www.statistik.at/web_de/statistiken/menschen_und_gesellschaft/bevoelkerung/haushalte_familien_lebensformen/lebensformen/index.html (retrieved 1.1.2021).

- Church resignations, https://www.katholisch.at/statistik (retrieved 1.1.2021).

- David Precht, ZDF television programme with Matthias Lanz 18.10.2019.

- Hanno Mussler, https://www.faz.net/aktuell/finanzen/sparkassen-check/sparkassen-und-vr-banken-verlieren-junge-kunden-14506516.html (retrieved 1.1.2021).

- Dr Gerhard Ummenberger, private communication, 2020.

- Lauer T. Designing bonus programmes correctly. Harv Bus Manag. 2002;2002(3):98-106.

- Statista Banking Report Austria, 2019.

- Folder Cashback, January 2020.

- Alexander Diethard, ValueMaster, https://www.ccv.eu/2020/interview-how-has-corona-changed-your-business/ (retrieved May 2, 2021).

- Alexander Diethard, interview on 7.4.2021.

- www.tableau.com (retrieved May 2, 2021).

- https://www.gartner.com/doc/reprints?id=11YAE9AY1&ct=200206&st=sb (retrieved May 2, 2021).

- Vana P, Lambrecht A, Bertini M. Cashback is cash forward: delaying a discount to entice future spending. J Mark. 2018;55(6):852-68.

- Christino JM, Silva TS, Cardozo EA, et al. Understanding affiliation to cashback programs: An emerging technique in an emerging country. J Retail Consum Serv. 2019;47:78-86.

- Ballestar MT, Grau-Carles P, Sainz J. Customer segmentation in e-commerce: Applications to the cashback business model. J. Bus. Res. 2018;88:407-14.

- https://www.ebates.com/help/article/company-overview-115009254588 and https://www.quidco.com/business/about/ (retrieved May 3, 2021).

- Lauer T. Bonus programmes: Successfully designing discount systems for customers. Springer, Berlin (2011).

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref